WILL YOU BE READY IF A HURRICANE STRIKES? Guide for Pre-Storm Claim Preparation

A hurricane can severely interrupt your operations and wreak havoc on business plans, threaten customer and supplier relationships, and jeopardize short- and long- term growth targets. Developing a pre-loss plan of action is essential to successfully navigating the claims process and minimizing the impact of a hurricane on your business.

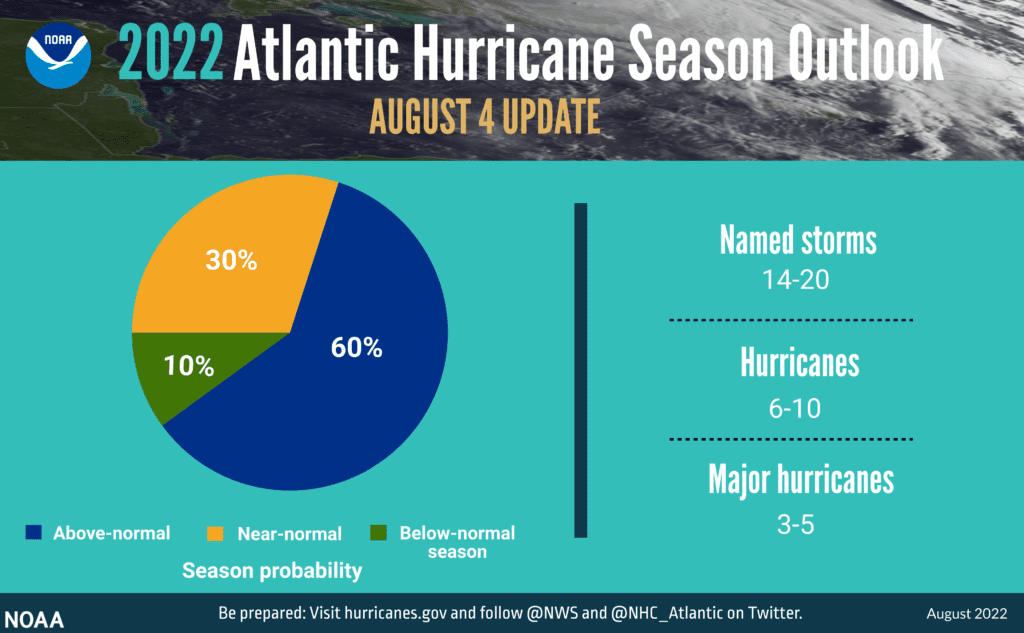

2022 is set to be another year marked by above-normal hurricane activity. RTFA has drawn upon decades of experience to develop this guide for disaster planning and recovery. Taking these initial steps will help to ensure that you are prepared to manage business interruption and losses resulting from a hurricane or other disaster.

Work with your broker to understand relevant policy terms and conditions for named storms, coverage triggers, waiting periods, and deductible structures. Understand your policy’s statement of values (SOV), and specifically whether hurricanes losses trigger business interruption coverage.

Form your claim team

Having a competent and knowledgeable team to assist policyholders in preparing your claim submission can expedite the claim process and greatly enhance recovery. Members of this team should have relevant experience and knowledge in your industry.

Engage with your adjustment team Interviewing and selecting an independent claims adjuster who knows your business and is familiar with your insurance program will put you ahead of the disaster curve. Similarly, insurance engineering consultants should be familiar with your building and equipment, and insurance auditors familiar with your business operations prior to a loss.

Review disaster recovery plans

Update your contingency plans, supply chain maps, and business continuity policies.

Identify sister facilities, idle machinery or temporary facilities that can be activated should the need arise.

Keep meticulous records

Properly document your claim and speed up recovery on the front end via daily status updates, photographs, videos, equipment logs, inventory records, customer/supplier communications etc. Create unique account codes to capture associated expenses and classify labor covered under the policy.

Before a hurricane strikes… your business must be prepared and protected. RTFA’s hurricane preparedness team can assist in the process – ensuring that you have critical knowledge of your policy and detailed procedures in place to mitigate losses before or after a disaster. Contact one of our claim experts to learn more.

Ronald P. Hajjar, CPA Managing Director

(972) 974-6091

[email protected]

Todd Gillman Managing Director

(312) 286-7608

[email protected]

Mike Mancuso Manager

(630) 640-6774

[email protected]

Andrew Browning Director

(432) 528-7473

[email protected]

Justin Bailey Director

(512) 217-2962

[email protected]

For more than 25 years, RTFA’s professionals have advised hundreds of insured businesses and organizations through the arduous and often unfamiliar insurance claim process. Our singular focus on complex claims and risk exposure, enables us to mobilize quickly to handle the unique needs of each client and achieve the best possible outcomes. Learn more about our service offerings at www.rtforensics.com